How to migrate posts from one WordPress to another WordPress

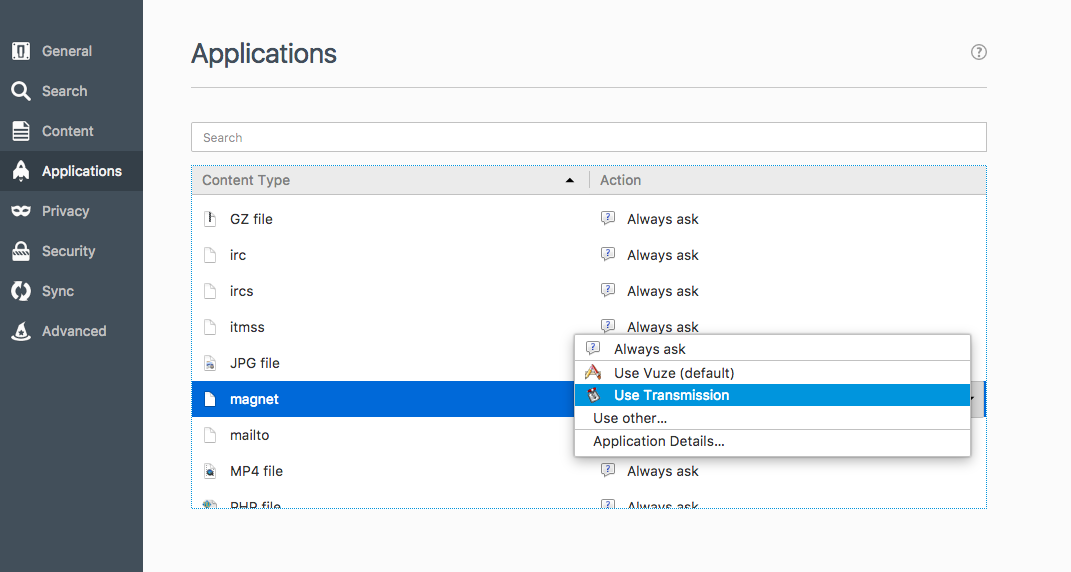

Either if you moving your blog from wordpress.org to your own domain or any other scenario, you may want to import all the content from one to the other. This technique works for any of the following scenarios: Hosted WordPress to another Hosted WordPress wordpress.com to Hosted WordPress Hosted WordPress to wordpress.com Exporting content Log […]